Finance4Kids Week One: Money

The earlier you start teaching your children about finance, the more prepared they will be for adulthood! In efforts to keep kids engaged this summer, we prepared #Finance4Kids

June Newsletter

The Blakely Financial Newsletters are packed with valuable information. Check it out here!

A Closer Look At Saving For Education Using A 529 Plan

Being that is it National 529 Day, we thought it would be appropriate to take a closer look a saving for education through a 529 plan.

Planning for Expectant Parents

If you or a loved one are planning to start a family, there are changes coming your way.

Teaching Children To Save & Budget

A healthy financial habit is to begin teaching your children the importance of saving and budgeting. As the old saying goes, the sooner, the better.

Caring for Aging Parents

Caring for aging parents can be a difficult planning aspect to balance. The first step—and often the most challenging one—is to find out what your parent needs or expects from you.

May Newsletter

The Blakely Financial Newsletters are packed with valuable information. Check it out here!

Understanding 401(k)’s

A 401(k) plan is a company-sponsored retirement plan that eligible employees can contribute a portion of their salary into a variety of investment options.

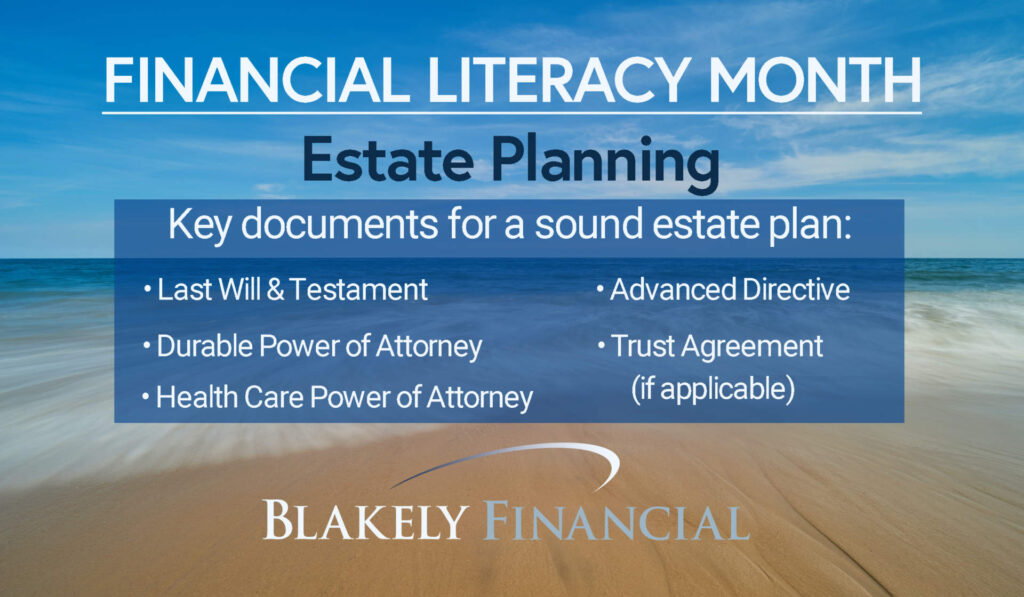

Estate Planning Documents

A well-thought-out estate plan can help manage and preserve your assets during life as well as protect your loved ones by conserving and directing distribution of assets at death.

All About ROTH IRAs

As you work and plan for your financial future, a possible strategy for savings is a Roth IRA. A Roth IRA is a retirement savings account that allows your money to grow tax-free.